Moral expectation

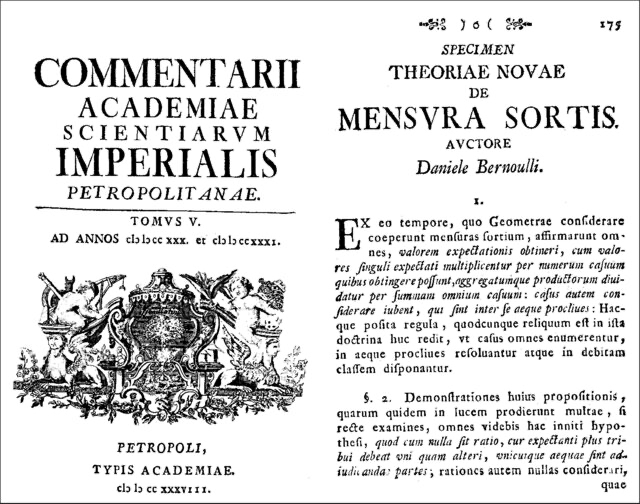

A significant advancement in the analysis of decision-making under risk occurred in 1738 when Daniel Bernoulli, a renowned Swiss mathematician, authored a paper in Latin titled “Specimen theoriae novae de mensura sortis,” which translates to “Exposition of a New Theory on the Measurement of Risk.”

In the paper, he introduces the concept of Moral Expectation.

Expected Return

Until then, risk was measured as follows:

Assume that the possible gains are ( r1, r2, r3 ) and their probabilities are ( p1, p2, p3 ) respectively.

§1. Ev = (p1r1 + p2r2 + p3r3)/(p1 + p2 + p3)1

Ev is the expected return. It is independent of the financial status of the individual. It can be also called average return.

§2. Assume a game in which heads give you ₹75 for every ₹100 bet, along with the ₹100 you have invested. If the result is tails, you lose ₹50.

Here, the expected return is ₹12.5. For a price of ₹100, you get an expected return of ₹12.5. It is the same for anyone playing the game, whether rich or poor. But in practice, we all know that although the prices are equal, the value derived should be different. Price and value are two different beasts altogether.

What is Price?

It is the cost of a thing and depends only on the thing itself. It is equal for everyone.

What is Value?

Value is the utility a thing yields. It depends on the circumstances of the person who is estimating the value.

Bernoulli’s moral expectation is based on value, not on price.

Moral Expectation

§3. Me = [(x+a)p1 x (x+b)p2]1/(p1+p2) -x

Me is the Moral Expectation.

- ( x ) is the fortune in hand.

- ( a ) and ( b ) are the gain or loss.

- ( p1 ) and ( p2 ) are the probabilities.

In other words, §3 is the geometric mean of all possible returns.

If we calculate the moral return of §2, it is ₹-6.46 if the entire fortune of ₹100 is used for the bet2.

If the individual has ₹200, and only ₹100 is employed in the bet, Me becomes ₹3.1.

From this, it is clear that the moral expectation of a rich person and a poor person is always different. In a game of chance, if the probability of loss is significant, never deploy the entire capital, however big the expected gain is.

If the moral expectation indicates a loss, never deploy the entire capital into that venture, even if the average return or expected return shows positive potential.